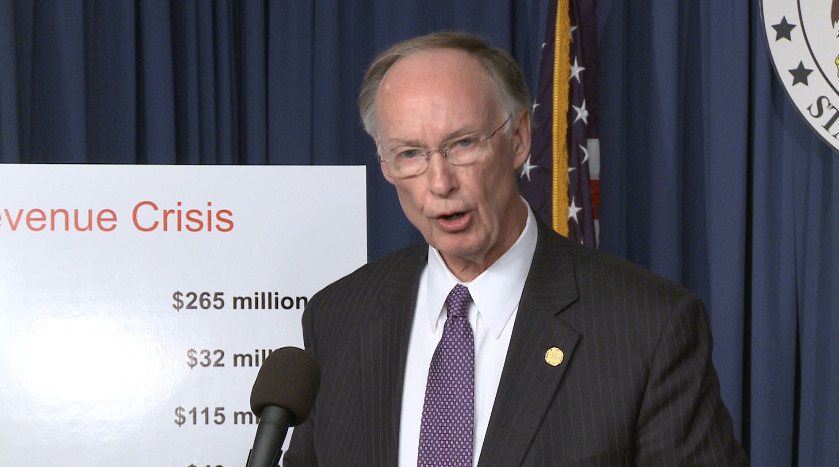

Governor Releases Tax Plan To Cover $700 Million Shortfall

Governor Robert Bentley has released his plan to raise taxes in Alabama.

It’s all to cover a 700 million dollar shortfall in the state’s general fund budget.

We’ve heard the governor talk about needing to raise taxes for weeks, and now we finally know what his ideas are.

The question now is how many of them will make it through the legislature.

One lawmaker already had a strong opinion of the governor’s plan before it was even released, and he put that opinion on display for everyone to see.

Now Senator Bill Holtzclaw’s district is temporarily missing out on funds for road projects.

Governor Bentley said those funds will be renewed at some point, but he’s glad most lawmakers waited to hear details of his tax proposal.

“My plan will not impact the majority of Alabamians. However, it will be fair to all Alabamians. now here are my proposals,” said Governor Bentley.

He outlined 8 points, adding up to about $550 million. Most of the money will come from raising automobile taxes to 4 percent, which the governor says is still lower than our neighboring states.

The plan also includes more than doubling the cigarette tax. And while that could discourage smokers, the governor says it will be worth it.

“So that certainly will over an amount of time decrease the amount of money we will receive as far as taxes are concerned. But you are exactly right. It will help us in the long run because it will help our health outcomes,” said Bentley.

The rest of the $187 million will come from unearmarking money in the general fund budget. Bentley says that plan will be out Monday.

The governor considered other options, like a lottery, but says ultimately, the money would take too long to get back to the state.

“If we had chosen some things like gambling or the lottery, all of those would have had to be voted on in September and had we chosen those as part of the solution, the money that you get from those would probably be months down the road,” said the governor.

The governor pointed out that none of these taxes will affect your property tax. Only a very few will see a change in their income taxes as well.

This is only a proposal. The governor will send his plan to the legislature next week, where lawmakers will have their chance to make some changes.

Here is the governor’s full proposal.

- Corporate Income Tax

- Require combined income reporting for corporations that do business in other states.

- Estimated increase in revenue – $20 million

- Financial Institution Excise Tax

- Remove the credit that financial institutions receive for sales taxes paid

- Estimated increase in revenue – $1 million

- Insurance Premium Tax

- Remove the credit for state privilege tax paid by insurance companies

- Remove the credit for ad valorem tax paid by insurance companies

- Remove the office facilities and real property investment credits made by insurance companies

- Estimated increase in revenue – $25 million

- Public Utilities License Tax

- Remove exemption that applies to municipal utilities

- Estimated increase in revenue – $47 million

- Individual Income Tax

- Eliminate income tax withholding exemption certificates

- Estimated increase in revenue – $12 million

- Sales Tax for Automobiles

- Increase the rate for automobile sales to 4%

- Estimated increase in revenue – $200 million

- Rental Tax for Automobiles

- Increase the automobile rental tax to 4%

- Estimated increase in revenue – $31 million

- Cigarette and Tobacco Tax

- Increase the tax to $1.25 per pack (increase of $0.825 per pack)

- Increase tax on other tobacco products proportionately

- Keep wholesalers’ discount the same as current

- Estimated increase in revenue – $205 million